A “High Cost Gas Well” refers to a natural gas well that is particularly expensive to drill and operate due to factors like its extreme depth, geological formation, or need for specialized extractions methods. These wells often qualify for state-level tax incentives to encourage development of the state’s natural resources.

If you operate in the state of Texas , you could be eligible for severance tax rate reductions. Give us a call and let us do the leg work to determine if your wells qualify. We can file for the exemptions and recoup previously paid taxes.

Form ONRR-2014 or the Report of Sales and Royalty Remittance, is used to report royalties and other obligations due on Federal and Indian oil and gas, and geothermal leases.

In various states, marketing costs can be deducted from the taxable value used to compute your production taxes. Often times it can be difficult to determine which costs are allowed or disallowed as marketing deductions. You may also be able to compute a rate per MCF which can be used to calculate your marketing deductions.

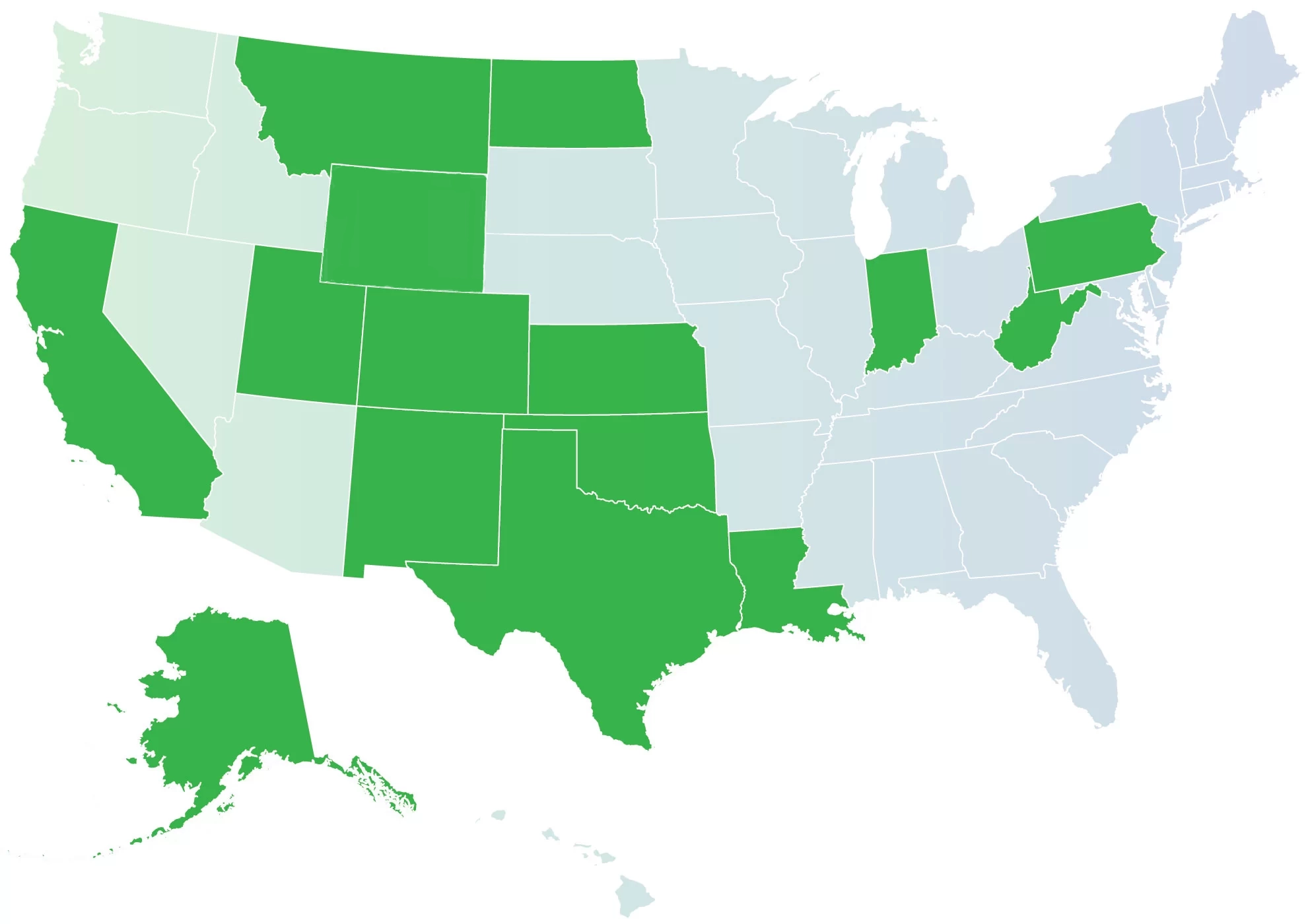

Do you operate wells that produce low volumes? You may qualify for tax incentives that reduce the operational burden. As each state has their own incentive program, let us do the leg work to determine which wells qualify for reduced tax rates.

Do you operate on Indian leases that are burdened by a severance tax obligation in addition to the royalty? Have you been contacted by a Tribal tax department concerning unpaid severance taxes? You may be overpaying your state taxes if you are not reducing it for any paid Tribal taxes.

A “High Cost Gas Well” refers to a natural gas well that is particularly expensive to drill and operate due to factors like its extreme depth, geological formation, or need for specialized extractions methods. These wells often qualify for state-level tax incentives to encourage productions.

If you operate in the state of Texas , you could be eligible for severance tax rate reductions. Give us a call and let us do the leg work to determine if your wells qualify. We can file for the exemptions and recoup previously paid taxes.

Form ONRR-2014 or the Report of Sales and Royalty Remittance, is used to report royalties and other obligations due on Federal and Indian oil and gas, and geothermal leases.

In various states, marketing costs can be deducted from the taxable value used to compute your production taxes. Often times it can be difficult to determine which costs are allowed or disallowed as marketing deductions. You may also be able to compute a rate per MCF which can be used to calculate your marketing deductions.

Do you operate wells that produce low volumes? You may qualify for tax incentives that reduce the operational burden. As each state has their own incentive program, let us do the leg work to determine which wells qualify for reduced tax rates.

Do you operate on Indian leases that are burdened by a severance tax obligation in addition to the royalty? Have you been contacted by a Tribal tax department concerning unpaid severance taxes? You may be overpaying your state taxes if you are not reducing it for any paid Tribal taxes.

Have you received a letter from ONRR indicating volume discrepancies between your production and royalty reports? Do you need help researching these discrepancies and corresponding with ONRR? Even if you handle your monthly reporting in-house, we can take care of these requests so you can focus on staying compliant on your current month accounting.

Have you been notified that your company has been selected for Audit? We understand audits can be daunting, but we are here to help. Let us be the point of contact between your company and ONRR; we will take care of the heavy lifting by answering their questions and providing documentation to satisfy their requests.

We offer comprehensive support, from expert consultations to detailed reporting, helping clients streamline their tax processes and avoid compliance issues.

Mia Downing